About Us

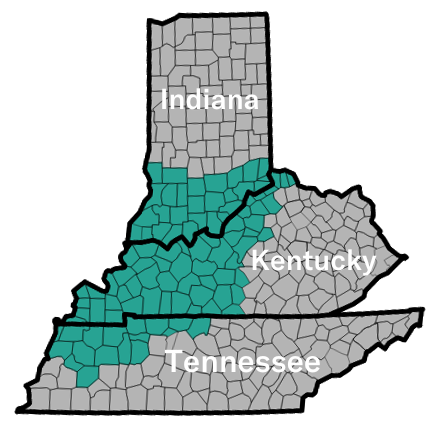

AHA Insurance Network is the largest IA Network in Southern Indiana and Kentucky, serving over 98 counties in Southern Indiana, Kentucky, and Western Tennessee. AHA is not just an “aggregator” of premium (like many) but a partner dedicated to helping every member develop the necessary components for a growing, independent agency they can be proud of. AHA is a regional member of SIAA - The Agent Aliance, the largest alliance of independent insurance agencies in the United States.

AHA by the Numbers

Our Story

In 1998, AHA Insurance Network (previously Agents Helping Agents) was formed after our founder, Tim Hyland, had spent over a decade within the independent insurance agency framework with his agency Hyland Insurance and was starting to feel the constraints of being “small” by carriers. When looking for ways to succeed while remaining independent, Tim was approached by SIAA – Agent Alliance to become one of the first SIAA Master Agencies outside New England. A new entity, AHA Insurance Network, was formed for the purpose of establishing a large regional alliance of local agencies.

From the beginning, we at AHA Insurance Network have prided ourselves on being members of SIAA – The Agent Alliance, established in 1995. Today, SIAA is recognized as the most significant agency partnership in the U.S. Our status as a regionally exclusive SIAA Master Agency in this innovative, prestigious organization provides our members access to carrier partners typically unavailable to the independent agent. SIAA enables our members to compete with captive agencies by providing their clients with competitively priced insurance and the highest level of customer service.

Today, AHA has over 150 members across Southern Indiana, Central Kentucky, and Western Tennessee. AHA’s vision is to see every independent agency thrive and reach its highest potential so that together, we become the most sought-after partnership of next-generation insurance leaders.

AHA Insurance Network is the largest IA Network in the Southern Indiana and Kentucky area.

We Are AHA Insurance Network

AHA Insurance Network is a SIAA Regional Master Agency with over 150+ members spanning across Southern Indiana, Central Kentucky, and Western Tennessee.

|

|

OUR VISION

To see every independent agency thrive and reach its highest potential so that together, we become the most sought-after partnership of next-generation insurance leaders.